Adoption Tax Credits: Utilization, State Expansions, and Taxpayer Savings (2022)

By Matt Connell and Maria Donovan

This is Issue 87 in the On Point Series.

In 2013, the Charlotte Lozier Institute published a report titled, “The Adoption Tax Credit: Progress and Prospects for Expansion.” The report both outlines the history of the adoption tax credit at the federal level and analyzes the number of states that provide some form of tax relief for adoption. An update to the original report was published in August of 2017. Since the original reports were published, the federal adoption tax credit has continued to increase in dollar amount and is utilized by tens of thousands of Americans pursuing adoption each year. In addition, several states have created or expanded adoption tax credits at the state level, helping to offset adoption costs for American families. Unfortunately, one state, Montana, recently decided to end its adoption tax credit program.

Federal Adoption Tax Credit

Since its inception in 1996 as a $5,000-maximum credit per child set to expire in 2001, the federal adoption tax credit has both been made permanent and been set to adjust annually for inflation.[1] Accordingly, the maximum credit amount for 2021 has risen to $14,440.[2] Furthermore, while the credit is nonrefundable, it can be carried forward for five years. Many American families take advantage of the credit yearly, with nearly 80,000 taxpayers claiming the credit in 2017.[3] The average credit claimed that year was $5,072, and the total amount of adoption tax credits claimed by families was $404 million.[4] Similarly in 2018 an estimated $400 million in relief was granted to adoptive families.[5]

State Adoption Tax Credit

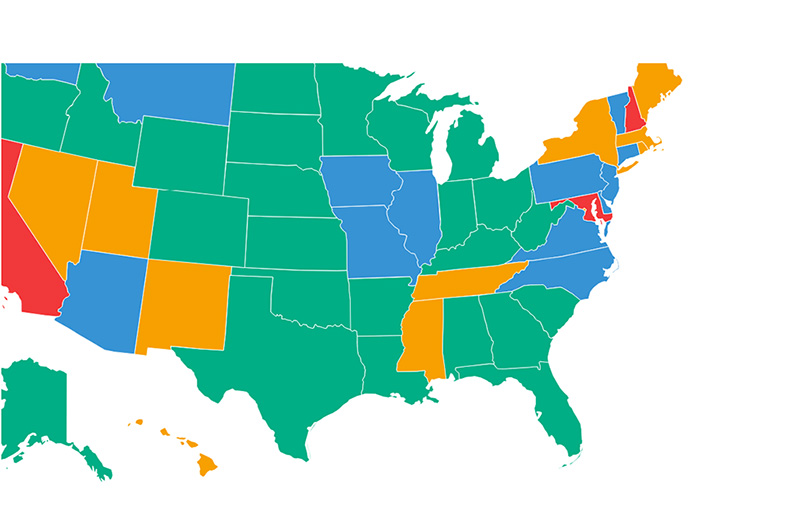

From 2018 to 2022, three states created some form of tax relief for residents adopting children: Idaho, Illinois, and Louisiana. Additionally, Missouri and Iowa expanded their adoption tax program. In the same time period, the Montana legislature allowed its adoption tax credit to expire as part of a comprehensive overhaul of the state’s entire tax code. The credit was one of 16 credits that were not renewed as part of the state’s development of a simpler code.[6] Montana taxpayers may carry forward any unused portion of the credit, however, for up to five years.[7] This brings the total number of states providing tax relief for adoption to 21(see table below). It is noteworthy that seven states, not included in the count of states providing adoption tax relief, have no income tax at all. Additionally, Tennessee[8] and New Hampshire do not tax wages.[9]

The tax relief created by the three states mentioned is as follows:

- In 2018, Illinois created a tax credit with a maximum of $2,000 per eligible child or $5,000 per eligible child who is at least one year of age and also a resident of the state at the time of adoption.[10]

- Idaho adopted a deduction for legal and medical expenses associated with an adoption. This deduction is a maximum of $10,000 for adoptions in taxable years beginning after 2017.[11]

- Most recently, Louisiana passed a deduction law in June 2021 with a deduction maximum of $5,000.[12]

In addition to these newly created tax credits, two states increased the maximum tax credit available per adopted child.

- Missouri recently revised its existing adoption tax credit to include all adoptions. Previously the credit had been for only those adoptions of special needs.[13]

- Iowa expanded its existing adoption tax credit from $2,500 to $5,000.[14]

Despite these gains, 20 states and the District of Colombia provide no tax relief for adoption beyond the relief provided at the federal level, excluding those nine states which do not tax either income or wages.

Taxpayer Savings

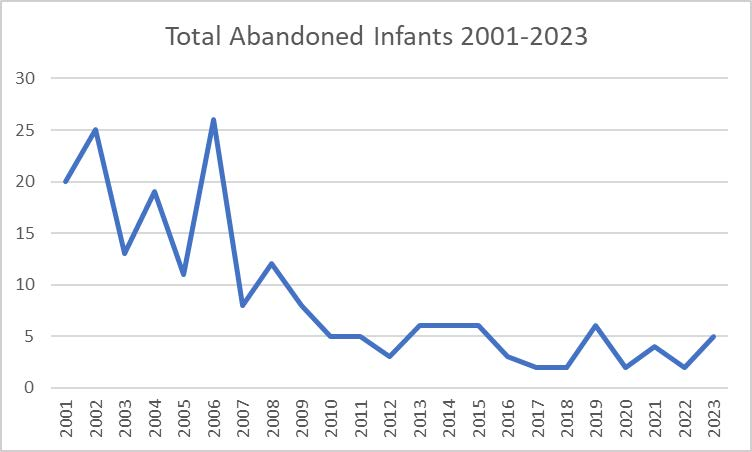

Adoption tax credits not only alleviate financial burdens for adopting families, but also lower costs to taxpayers in both the short and long term. A 2011 report published by the National Council for Adoption reveals that for every child adopted out of foster care, taxpayers save $15,480 in state and federal expenditures.[15] This dollar amount accounts for the maintenance and administrative costs of both foster care and adoption for each child. Furthermore, the societal benefits of placing foster children in permanent homes are numerous, including lower incarceration rates, higher rates of employment, and less dependence on government benefits, saving the taxpayer even more in the long term.[16] Multiplying these benefits by the more than 50,000 children adopted out of foster care every year results in hundreds of millions of dollars of taxpayer savings. [17]

Conclusion

The adoption tax credit is a simple and effective way for states to promote a culture of adoption and help alleviate the expenses incurred by tens of thousands of American families trying to adopt, while also easing the burden on the taxpayer. With less than half of states providing tax relief for those trying to adopt, there remains substantial room for improvement in creating a more adoption-friendly climate across the nation. The Charlotte Lozier Institute lauds those states which have created or expanded adoption tax credits and reiterates its call for more states to support families choosing this life-affirming path.

| Table 1. State Adoption Tax Relief | ||

| State | Adoption Tax Credit | Amount and Notes |

| Alabama | Yes | Up to $1000, Both birth mother and adoptive parents must reside in Alabama |

| Alaska | No State Income Tax | Alaska does not have a state income tax |

| Arizona | Yes | Has various assistance programs for the adoption of “special needs” as well as reimbursement sup to $2000 |

| Arkansas | Yes | A credit of 20 percent of federal adoption tax credit claimed |

| California | Yes | Up to $2,500 for 50% of qualified costs in the year an adoption is order |

| Colorado | No | |

| Connecticut | No | |

| Delaware | No | |

| Florida | No State Income Tax | |

| Georgia | Yes | Credit of up to $2000 |

| Hawaii | No | |

| Idaho | Yes | |

| Illinois | Yes | |

| Indiana | Yes | The lesser amount of $1,000 per child or 10% of your claimed federal adoption tax credit (nonrefundable) |

| Iowa | Yes | Expanded to $5,000 of unreimbursed expenses related to an adoption per child adopted in Iowa. |

| Kansas | Yes | 25% of the adoption credit allowed on your federal income tax return for adopting a child or children, bumps up to 50% if adopted child was resident of KS before adoption and has special needs. For special needs adoption, an additional $1,500 credit is available. |

| Kentucky | No | |

| Louisiana | Yes | Signed by Gov. Edwards in June 2021. In effect 2022 |

| Maine | No | |

| Maryland | No | |

| Massachusetts | No | Exemption for adoption fees paid to a licensed adoption agency in the taxable year |

| Michigan | No | Had a credit until Legislature ended in 2011. Various legislation proposed since then has been unsuccessful |

| Minnesota | No | |

| Mississippi | Yes | Up to $2,500 for qualified adoption expenses. Can apply for the credit when the adoption is finalized and can be carried froward for three years. |

| Missouri | Yes | |

| Montana | No | Repealed by 2021 state legislature |

| Nebraska | No | |

| Nevada | No State Income Tax | No state income tax |

| New Hampshire | No | |

| New Jersey | No | |

| New Mexico | Yes | Up to $1,000 per eligible child, only for children with special needs |

| New York | No | |

| North Carolina | No | |

| North Dakota | No | |

| Ohio | Yes | The greater of $1,500 or up to $10,000, any unused portion can be carried up to 5 years |

| Oklahoma | Yes | Technically a deduction, up to $20,000 for non-recurring expenses in the calendar year |

| Oregon | No | The state’s credit expired in 2005 |

| Pennsylvania | No | |

| Rhode Island | No | |

| South Carolina | Yes | May be eligible for $2,000 income deduction if child adopted has special needs and child is a dependent on federal tax return |

| South Dakota | No | |

| Tennessee | No State Income Tax | |

| Texas | No State Income Tax | |

| Utah | Yes | Up to $1,000 refundable credit for special needs |

| Vermont | No | |

| Virginia | No | |

| Washington | No Income Tax | |

| West Virginia | Yes | Up to $4,000 which can be taken over a period of three years. |

| Wisconsin | Yes | Up to $5,000 deduction |

| Wyoming | No | |

To view the table as a PDF with sources, please see: State Adoption Tax Relief Table

Matt Connell and Maria Donovan are guest contributors for the Charlotte Lozier Institute. Portions of this article were previously published in “Adoption Tax Credits: Utilization, State Expansions, and Taxpayer Savings” (2017) by Matt Connell.

[1] https://adoptioncouncil.org/publications/understanding-the-adoption-tax-credit/

[2] https://www.irs.gov/newsroom/understanding-the-adoption-tax-credit

[3] 2020 Congressional Research Service report: “Adoption Tax Benefits: An Overview” (Updated May 18, 2020), https://fas.org/sgp/crs/misc/R44745.pdf

[4] Ibid.

[5] https://www.taxpolicycenter.org/briefing-book/what-adoption-tax-credit

[6] https://taxfoundation.org/montana-tax-reform/

[7] https://montana.servicenowservices.com/citizen/kb?id=kb_article_view&sysparm_article=KB0013393

[8] https://www.hrblock.com/tax-center/filing/states/tennessee-taxes/

[9] https://ttlc.intuit.com/questions/1901267-which-states-don-t-have-income-tax

[10] https://www2.illinois.gov/rev/research/publications/bulletins/Documents/2019/fy-2019-02.pdf

[11] https://casetext.com/regulation/idaho-administrative-code/title-idapa-35-tax-commission-state/rule-350101-income-tax-administrative-rules/section-350101185-adoption-expenses

[12] https://legis.la.gov/legis/BillInfo.aspx?s=21RS&b=HB424&sbi=y

[13] https://imprintnews.org/uncategorized/missouri-governor-signs-foster-care-adoption-tax-breaks/53855

[14] https://tax.iowa.gov/sites/default/files/2020-12/IA177%2841154%29.pdf

[15] https://www.adoptioncouncil.org/images/stories/NCFA_ADOPTION_ADVOCATE_NO35.pdf

[16] “The Financial Logic for Recruiting More Foster Parents”

[17] 2017 “Adoption: By the Numbers” report

https://indd.adobe.com/view/4ae7a823-4140-4f27-961a-cd9f16a5f362