-

Research & Data

CategoriesPublication TypesResearch TypesTrending Research

-

Initiatives

Abortion Drug Facts: Research shows the rate of abortion pill-related emergency room visits has increased.

Pregnancy Center Reports: Read about the work of pregnancy centers nationally and at the state level.

Evaluation Of Human Fetal Tissue Research: Learn about federal funding for research using human fetal tissue.

Stem Cell Research Facts: Learn about the incredible possibilities of stem cell research.

Signs of Life: One of the most striking things about the realm of science fiction is that it is seldom fiction.

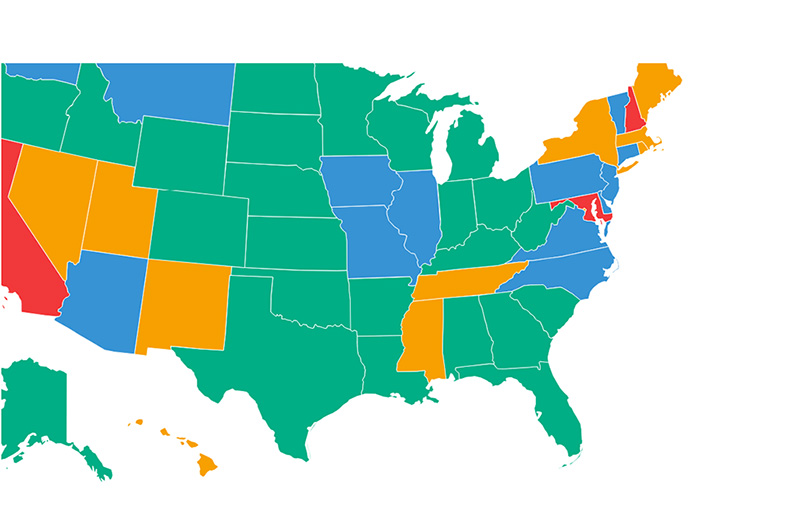

State Abortion Reporting: Learn about state abortion reporting.

Facts not Fear: Will Pro-Life State Laws Hurt Women and Hinder Doctors?

Assault on Science: Refuse to let journals and editors launch meritless attacks without a fight.

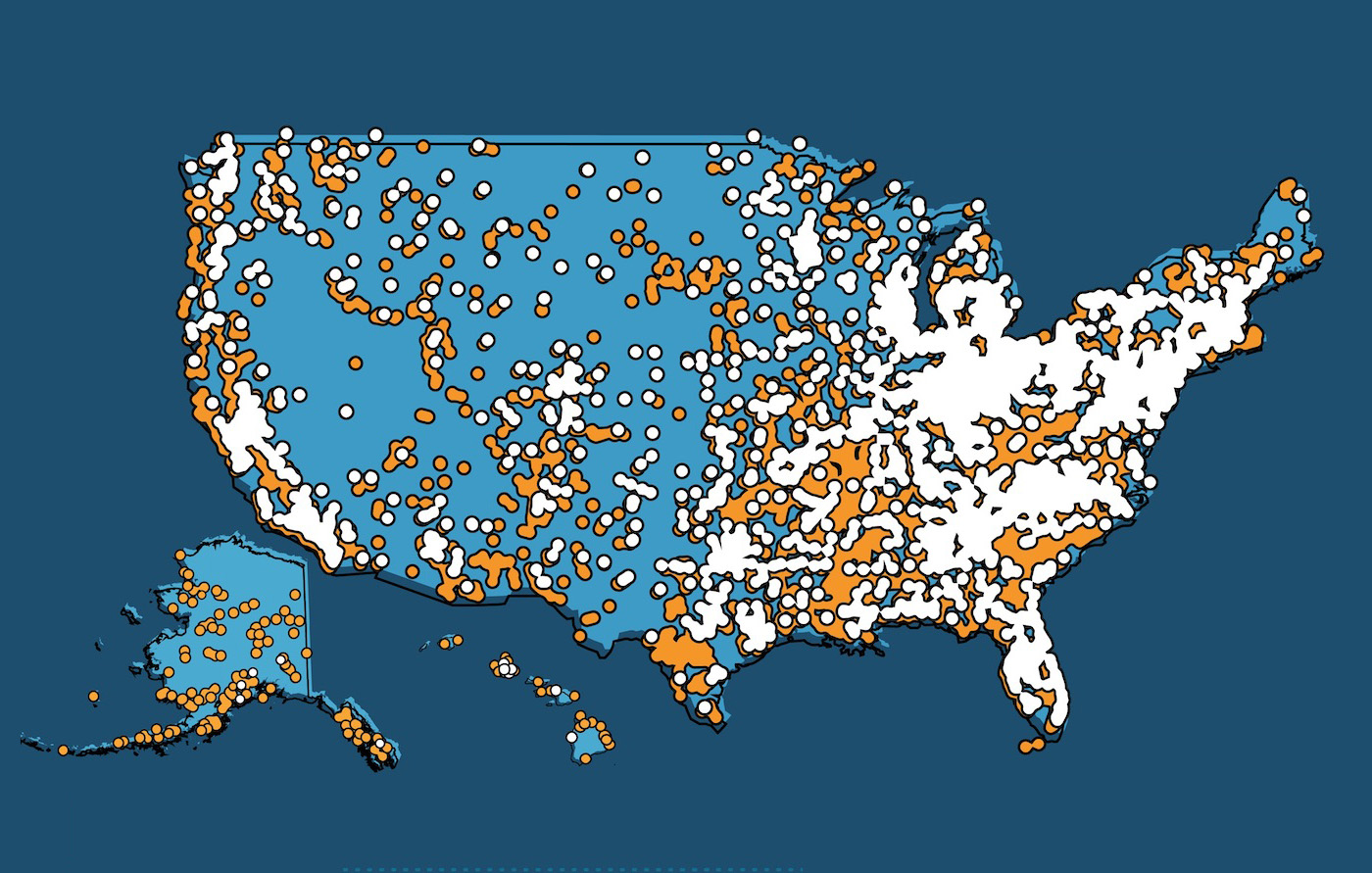

Women Have Real Choices: There are 14 women's health and pregnancy centers for every Planned Parenthood.

- Voyage Of Life